Maximize Your Benefits with VA Home Loans: Lower Rate Of Interest Fees and Flexible Terms

Maximize Your Benefits with VA Home Loans: Lower Rate Of Interest Fees and Flexible Terms

Blog Article

Comprehending Just How Home Loans Can Promote Your Trip Towards Homeownership and Financial Security

Navigating the intricacies of home loans is important for anyone striving to achieve homeownership and establish monetary stability. Numerous types of financings, such as FHA, VA, and USDA, offer distinctive benefits customized to different circumstances, while comprehending rates of interest and the application process can considerably influence the general price of a home. Handling your home loan efficiently can lead to lasting monetary advantages that prolong past plain ownership. As we think about these important elements, it comes to be clear that the path to homeownership is not practically securing a finance-- it's about making educated options that can shape your economic future.

Sorts Of Home Loans

Standard fundings are a popular alternative, normally calling for a greater credit history and a deposit of 5% to 20%. These loans are not insured by the federal government, which can cause more stringent qualification standards. FHA financings, backed by the Federal Housing Management, are made for first-time homebuyers and those with lower credit report scores, enabling for deposits as reduced as 3.5%.

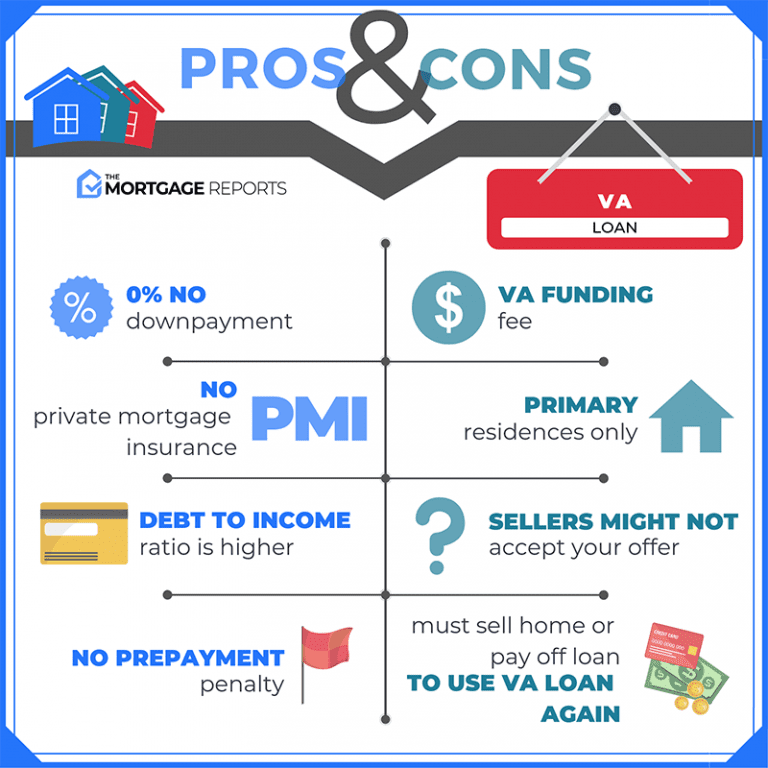

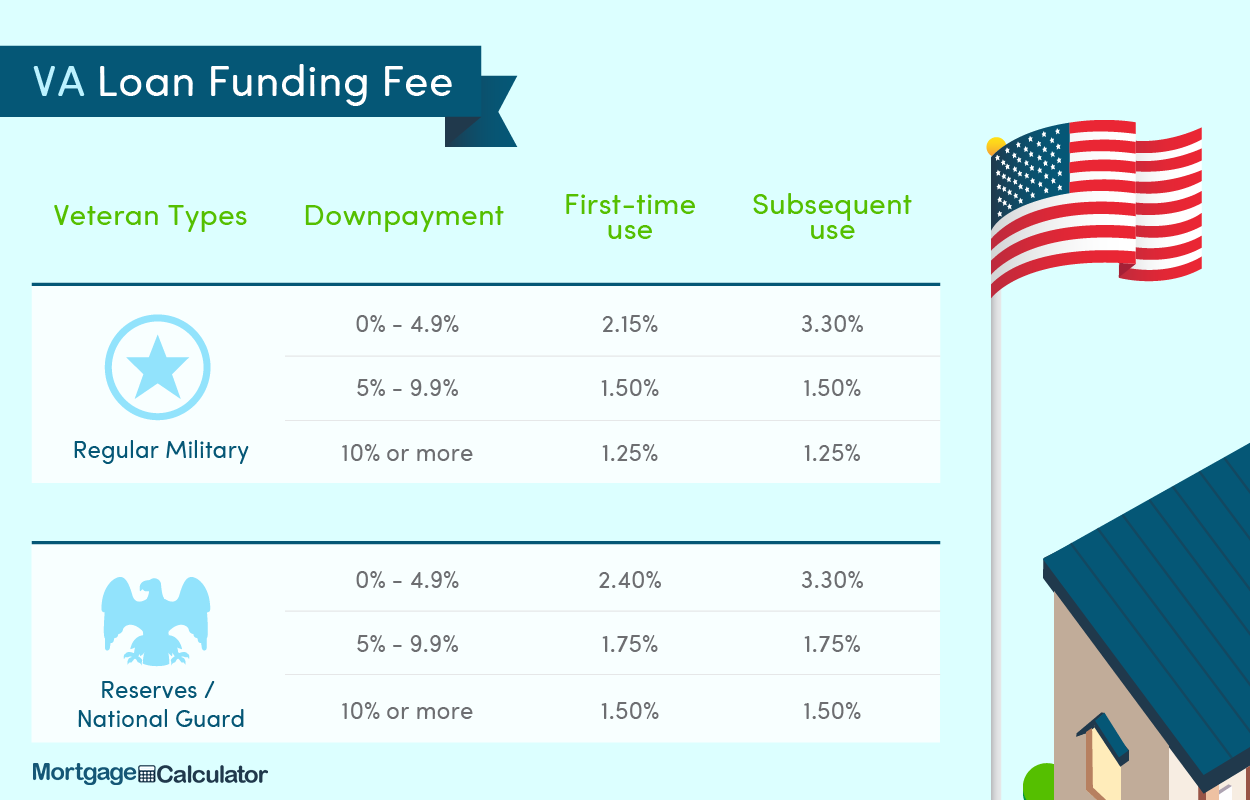

VA financings, available to experts and active-duty military personnel, supply favorable terms such as no private home mortgage and no down repayment insurance coverage (PMI) USDA loans cater to rural buyers, advertising homeownership in much less densely populated areas with low-to-moderate income degrees, additionally calling for no deposit.

Last but not least, adjustable-rate mortgages (ARMs) supply lower initial prices that readjust in time based upon market problems, while fixed-rate mortgages offer secure monthly payments. Understanding these choices enables potential homeowners to make informed choices, straightening their economic goals with one of the most appropriate funding kind.

Comprehending Rate Of Interest

Rate of interest play a pivotal role in the home mortgage process, dramatically influencing the overall expense of borrowing. They are essentially the expense of borrowing cash, shared as a percent of the lending amount. A reduced rate of interest price can lead to significant financial savings over the life of the financing, while a greater price can result in increased regular monthly settlements and complete passion paid.

Interest rates vary based on numerous elements, consisting of financial conditions, inflation prices, and the monetary plans of main financial institutions. A fixed price continues to be constant throughout the loan term, offering predictability in regular monthly payments.

Understanding exactly how rates of interest work is essential for prospective home owners, as they directly affect affordability and economic preparation. It is suggested to contrast rates from various lenders, as also a slight distinction can have a significant effect on the complete price of the loan. By following market trends, borrowers can make enlightened decisions that align with their monetary objectives.

The Application Refine

Browsing the mortgage application process can initially seem difficult, but recognizing its essential parts can simplify the trip. The very first action involves event necessary documents, including proof of earnings, income tax return, and a listing of liabilities and properties. Lenders need this information to review your monetary stability and credit reliability.

Following, you'll require to pick a lending institution that straightens with your monetary requirements. Research study different home mortgage items and rate of interest, as these can substantially affect your regular monthly repayments. When you choose a lending institution, you will certainly finish an official application, which may be done online or face to face.

Once your application is authorized, the lending institution will release a finance price quote, outlining the terms and expenses connected with the home loan. This crucial paper allows you to evaluate your choices and make notified choices. Efficiently browsing this application procedure lays a strong foundation for your trip toward homeownership and monetary stability.

Managing Your Home Loan

Handling your home loan successfully is crucial for preserving economic wellness and ensuring long-lasting homeownership success. A positive approach to mortgage administration involves understanding the terms of your funding, consisting of rate of interest rates, repayment schedules, and any prospective fees. Frequently examining your mortgage declarations can help you stay informed regarding your continuing to be balance and payment background.

Producing a budget that try this site accommodates your home loan repayments is important. Make certain that your month-to-month budget consists of not just the principal and interest yet additionally property tax obligations, house owners insurance policy, and upkeep costs. This thorough view will prevent financial stress and unanticipated expenditures.

This approach can dramatically reduce the total rate of interest paid over the life of the finance and shorten the settlement period. It can lead to lower monthly repayments or a more desirable financing term.

Lastly, maintaining open interaction with your loan provider can give clarity on choices offered should economic problems develop. By proactively managing your home mortgage, you can boost your financial stability and reinforce your path to homeownership.

Long-Term Financial Advantages

Homeownership uses substantial long-term economic benefits that prolong beyond mere shelter. Among best site the most considerable benefits is the potential for building gratitude. Gradually, actual estate generally values in value, permitting homeowners to develop equity. This equity serves as a financial property that can be leveraged for future investments or to finance significant life occasions.

In addition, homeownership provides tax obligation benefits, such as home mortgage passion deductions and building tax obligation deductions, which can considerably reduce a homeowner's taxable revenue - VA Home Loans. These reductions can cause significant financial savings, enhancing overall monetary stability

Furthermore, fixed-rate home mortgages secure home owners from climbing rental expenses, making sure predictable month-to-month repayments. This stability enables individuals to budget plan efficiently and strategy for future expenses, facilitating lasting economic objectives.

Homeownership likewise promotes a feeling of neighborhood and belonging, which can cause raised public interaction and support networks, better contributing to financial wellness. Eventually, the economic benefits of homeownership, consisting of equity growth, tax benefits, and cost security, make it a keystone of long-lasting monetary protection and wealth build-up for people and families alike.

Final Thought

In verdict, understanding home finances is necessary for navigating the course to homeownership and attaining monetary stability. Furthermore, effective home loan management and acknowledgment of long-lasting monetary benefits contribute substantially to building equity and cultivating neighborhood interaction.

Navigating the intricacies of home financings is crucial for anybody striving to attain homeownership and develop economic Full Article stability. As we think about these essential elements, it becomes clear that the course to homeownership is not just regarding protecting a car loan-- it's concerning making educated choices that can shape your economic future.

Understanding just how rate of interest rates work is critical for potential home owners, as they directly influence cost and economic preparation.Managing your home loan efficiently is crucial for keeping financial health and wellness and ensuring long-lasting homeownership success.In verdict, recognizing home financings is essential for navigating the path to homeownership and achieving financial stability.

Report this page